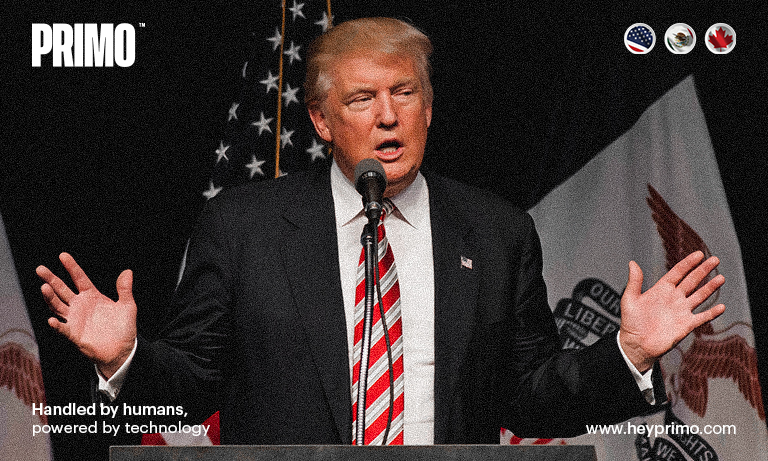

WASHINGTON (July 7, 2025) – President Donald Trump has set a firm deadline for August 1 as the date when new tariffs will begin to take effect for countries without finalized trade agreements. This extension supersedes the previously stated July 9 deadline, granting trading partners an extra few weeks to strike deals and avert punitive measures.

Over the weekend, major economies—most notably the European Union and Japan—rallied to reach last-minute trade agreements. The EU reported positive progress in discussions, with European Commission President Ursula von der Leyen and Chancellor Friedrich Merz engaging directly with the White House to hammer out frameworks ahead of the deadline thestar.com.my.

Financial markets have responded to the looming August 1 date with increased volatility. S&P 500 futures slipped about 0.5%, the dollar firmed up, and Asian currencies such as the Australian and New Zealand dollars lost roughly 1% on speculation that higher tariffs could hurt economies more exposed to goods trade thestar.com.my.

What’s At Stake

Industry Preparedness

Brokers are mobilizing to reserve freight capacity in anticipation of the surge surrounding August 1. Many are offering flexible arrangements to clients in case tariffs disrupt established supply flows or inflate transit times.

Stability in Turbulent Times

President Donald Trump threatened new tariffs on countries lacking finalized trade deals before an August 1 extension, fueling global market volatility. Major economies scrambled to secure last‑minute agreements as levies loomed and currency valuations fluctuated. PRIMO’s human‑driven, tech‑enabled freight solutions offer stability and resilience amid these unpredictable shifts, ensuring uninterrupted supply chain operations.

Bottom line: With the August 1 deadline looming, markets are on edge, and logistics networks are preparing for potential disruptions. Firms like PRIMO that combine human oversight with advanced technology may offer the steadiness and capacity management needed in this volatile trade landscape.